Roth Ira Contribution Limits 2020 Date

2019 amount of roth ira contributions you can make for 2019.

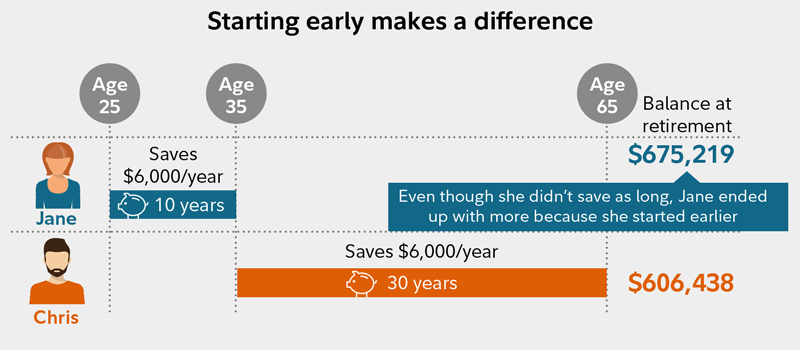

Roth ira contribution limits 2020 date. Funding your backdoor roth ira before the federal tax deadline april 15 2020 lets you enjoy tax savings for 2019 as well. The 2019 roth and traditional ira contribution limit is 6 000 or 7 000 if you re age 50 or older. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. In 2020 these amounts will stay.

Start with your modified agi. If you re age 50 and older you can add an extra 1 000 per year in catch up contributions. However you can still contribute to a roth ira and make rollover contributions to a roth or traditional ira regardless of your age. Roth 401 k participants who are age 50 or older can also contribute an additional 6 000 in catch up contributions as opposed to the 1 000 catch up allowed under roth ira rules.

Ira contributions after age 70. The income limitations on roth ira contributions don t affect the vast majority of taxpayers who can therefore save up to the maximum annual contribution limits. Amount of your reduced roth ira contribution. The roth ira contribution limit is 6 000 in 2019 up from 5 500 in 2018 people age 50 or older can add 1 000 but income limits may reduce how much you can contribute.

You may contribute simultaneously to a traditional ira and a roth ira subject to eligibility as long as the total contributed to all traditional and or roth iras totals no more than 6 000 7 000 for those age 50 and over for tax year 2019 and no more than 6 000 7 000 for those age 50 and over for tax year 2020. The maximum amount you can contribute to a roth ira for 2020 is 6 000 if you re younger than age 50. 196 000 if filing a joint return or qualifying widow er. 2020 amount of roth ira contributions you can make for 2020.

Roth 401 k contribution limits for 2019 are 19 000 much higher than the 6 000 allowed in a roth ira. Roth ira income limits.