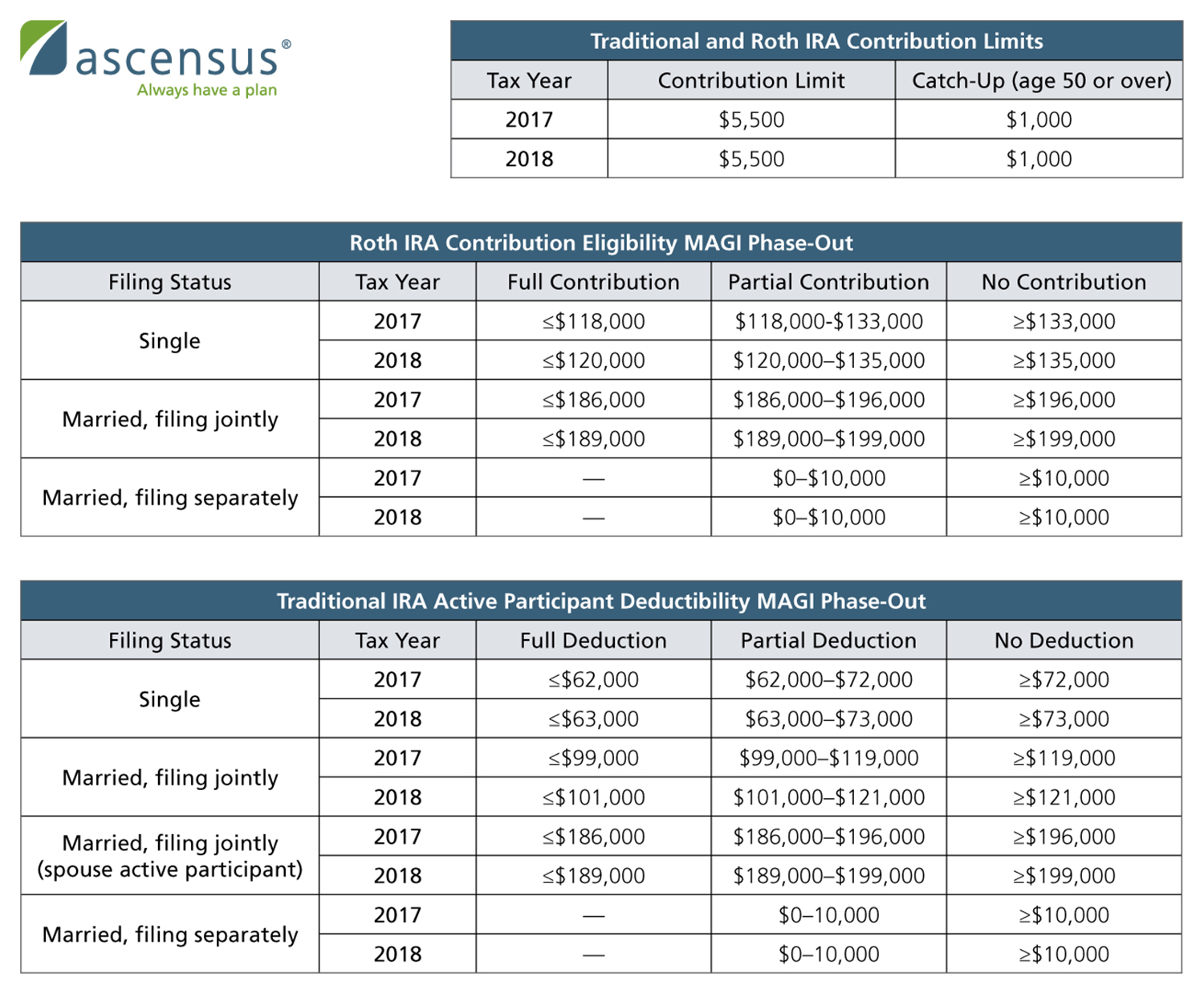

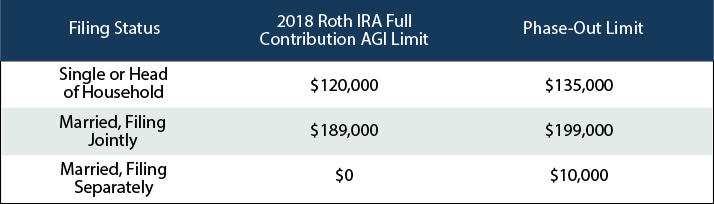

Roth Ira Contribution Limits 2017 Married Filing Jointly

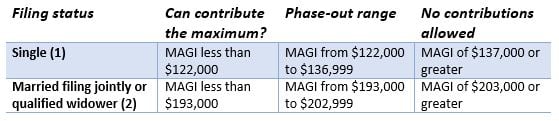

Roth Ira Contribution Limits For 2017 Nasdaq

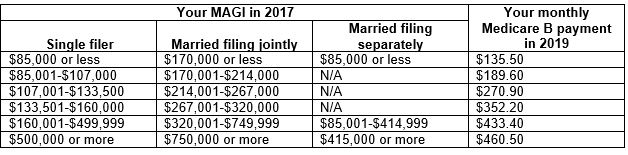

Is Social Security Taxable 2018 Update Finance Retirement

Federal Employees Ineligible To Contribute To A Roth Ira Can Use A

Ira And Retirement Plan Limits For 2018 Basepoint Wealth Llc

A Lot Of Married As Well As Separated Couples File Their Tax

Roth Ira Vs Traditional Ira Which Is Right For You Traditional

Get Ready For 2018 Contributions But Don T Forget 2017 Prior Year

Report Helpful Information For Filing 2019 Income Taxes

Roth Iras 8 Essential Rules And Strategies To Know

Roth Ira Vs Traditional Ira The Easiest Way To Turn 5 500 Into

Traditional Vs Roth Iras Allied Financial Partners Victor Ny

3 Ways To Avoid Paying The Medicare Surcharge Phillip James

Investing Archives Frankly Financial

Key 2017 Tax And Retirement Numbers Plan For It Oasis Wealth

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)

Do Tax Brackets Include Social Security

Using Online Calculators To Choose Between Traditional And Roth

Tax Tricks And Treats Are You Ready For The Grim Tax Reaper Wtop

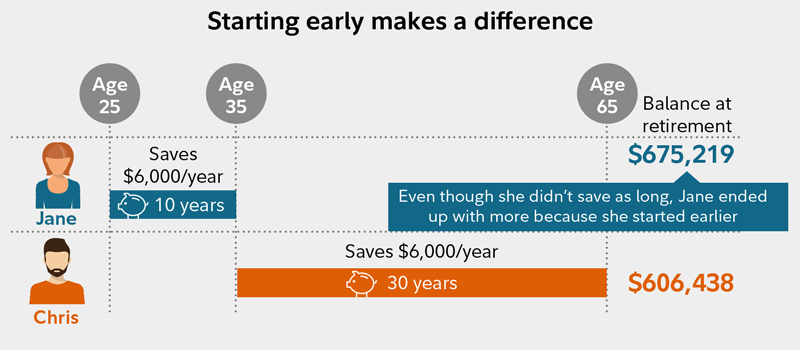

Why Contribute To An Ira Now Fidelity

Mid Year Planning Tax Changes To Factor In Symphony Financial

Do I Report A Roth Ira Contribution On A 1040 Finance Zacks